Windfall elimination calculator

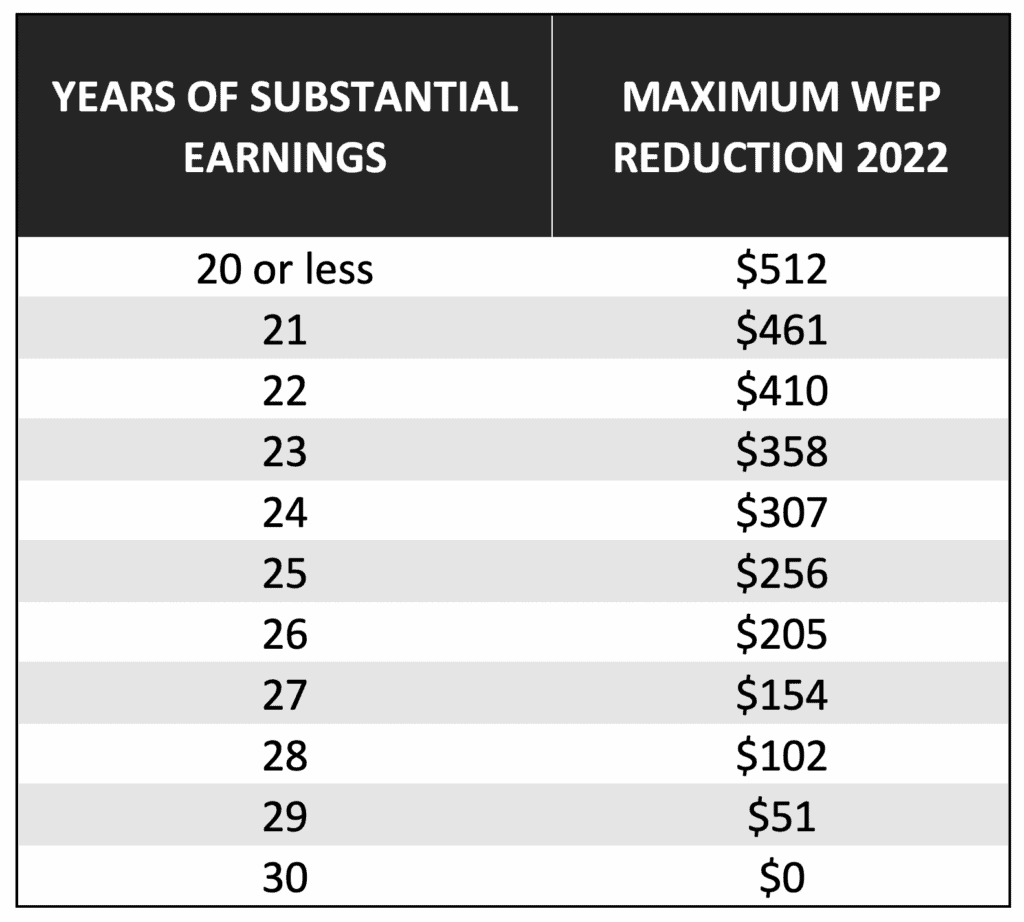

I live in Texas which is a Windfall Elimination Provision state. The Windfall Elimination Provision penalty reduces as you go from 20 to 30 years of service under FERS.

Debt Snowball Payoff Calculator See Your Payoff Date Nerdwallet

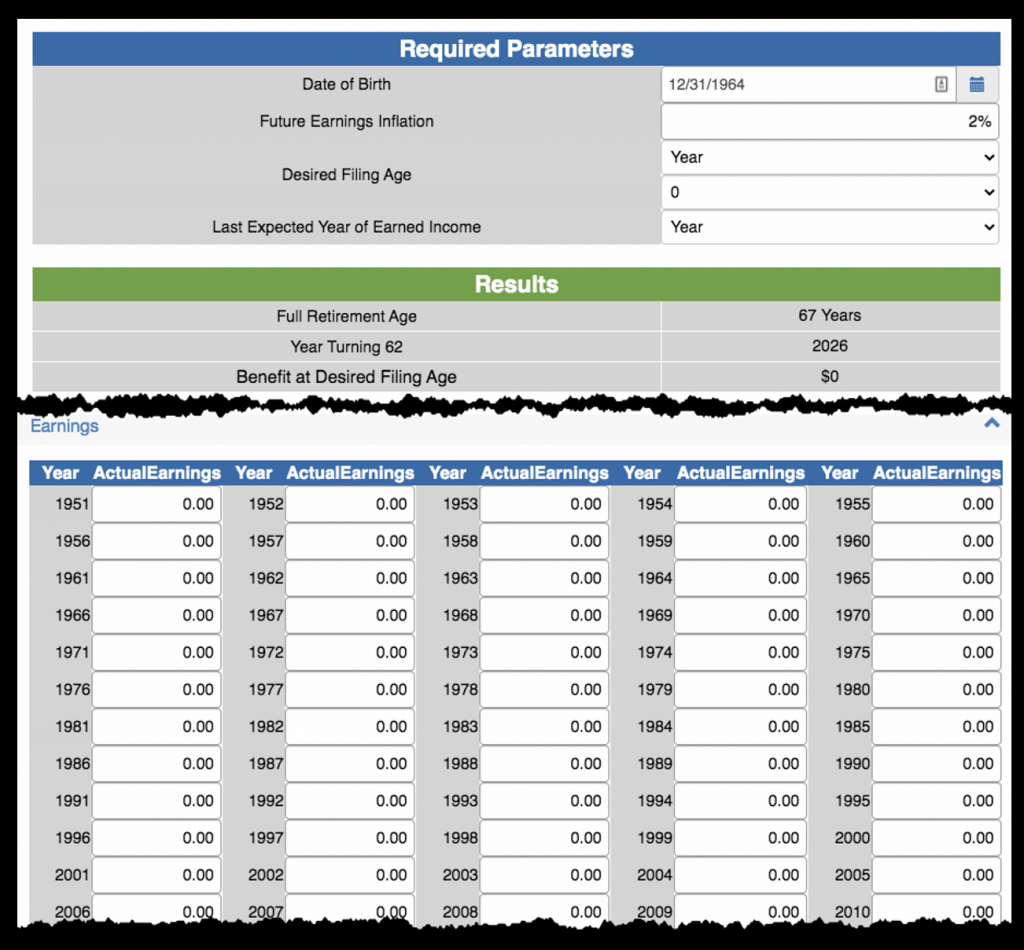

If you do not have 30 years of Social Security covered work a Social Security WEP Calculator can assist you to calculate the complex formula that will tell you your benefit amount.

. Windfall Elimination Provision WEP Calculator. Yes the WEP calculator on the SSA website does a good job of helping you calculate the reduced PIA. Resources.

If the latter applies you must first have become eligible for a monthly pension based on work where you didnt pay Social Security taxes after 1985. Pay Down Balances with a Windfall. The WEP may apply if you receive both a pension and Social Security benefits.

There is nothing that precludes you from getting both a pension and Social Security benefits. The Windfall Elimination Provision does not apply if. You were first employed by the government after December 31 1983.

Estimating the Amount of the Government Pension Offset and Windfall Elimination Provision. But there are some types of pensions that can reduce Social Security payments. The Windfall Elimination Provision can apply if one of the following is true.

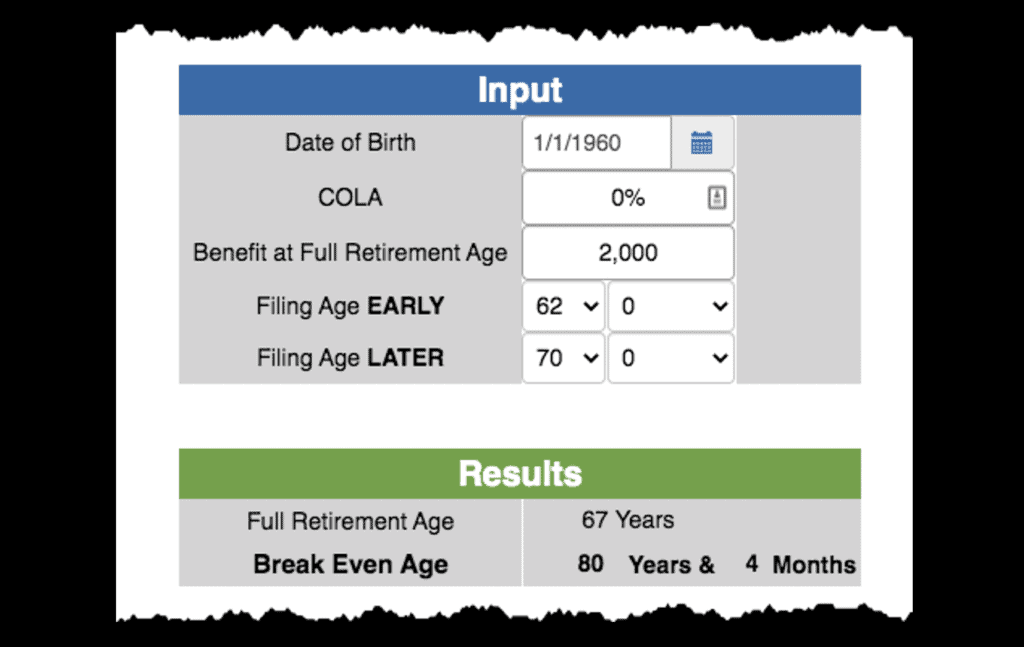

How the WEP is Calculated. Our Retirement Earnings Test Calculator can help you find out how much your benefits may be reduced if you are working and. For more information see the Social Security Administrations WEP Benefit Calculator.

Heres where the magic happens. If you are CSRS Offset social security benefits may be subject to CSRS Offset at age 62. Windfall Elimination Provision WEP This reduces your retirement or disability benefit if you receive a retirement or disability pension from work not covered by Social Security.

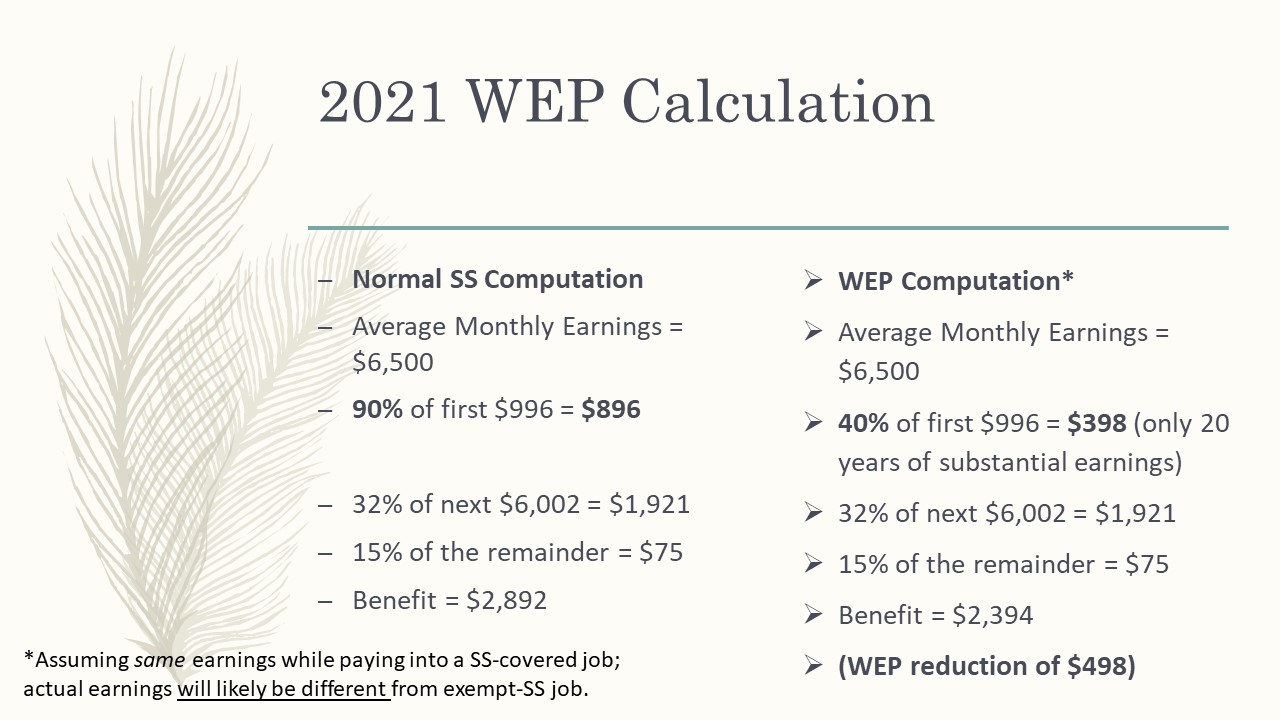

The Windfall Elimination Provision abbreviated WEP is a statutory provision in United States law which affects benefits paid by the Social Security Administration under Title II of the Social Security ActIt reduces the Primary Insurance Amount PIA of a persons Retirement Insurance Benefits RIB or Disability Insurance Benefits DIB when that person is eligible or entitled to a. You reached age 62 after 1985. A progressive scale of percentages is applied to your monthly earnings number to determine your monthly Social Security benefit.

When Social Security benefits are calculated the SSA inflates your historical earnings takes your highest 35 years of earnings and divides by 420 the number of months in 35 years. You also need to enter the monthly amount of your pension that was based on work not covered by Social Security. While your Social Security benefits are lowered under the WEP they cannot be totally eliminated.

Worcester Regional Retirement System 23 Midstate Drive Suite 106 Midstate Office Park Auburn MA 01501 Telephone. Windfall Elimination Provision WEP Many federal employees have held other jobs before during and after retirement including feds who served active military andor Reserve and National Guard duty where earnings were subject to Social Security. In 2019 your benefits would be the.

Estimate of your benefits in todays dollars or future dollars when you input your date of birth and this years earnings. Estimate if you are eligible for a pension based on work that was not covered by Social Security. You developed a qualifying disability after 1985.

Whether you use work bonuses or cash gifts from your loved ones it can help you make extra payments. The reduced cost-of-living adjustments have less effect if. You will need to enter all of your earnings taxed by Social Security which are shown on your online Social Security Statement.

Our Windfall Elimination Provision WEP Online Calculator can tell you how your benefits may be affected. You were eligible to retire before January 1 1986. More than 60 of police officers are feeling the pinch of the Windfall Elimination Provision WEP.

Or You have 30 or more years of substantial earnings under Social Security. The Windfall Elimination Provision may apply if you receive both a non-covered pension and Social Security retirement benefits. The Windfall Elimination Provision affects how your Social Security retirement or disability benefits are calculated if you are also entitled to receive a pension benefit for work not covered by Social Security.

If in the course of your career you worked for both 1 at least one employer that did withhold Social Security taxes and 2 at least one employer that didnt withhold Social Security taxes and that offers a pension the windfall elimination provision WEP may come into play. It applies only to workers who did not pay Social Security taxes and so did not earn credits toward Social Security income during their working. Resist the temptation to splurge and use this windfall to pay down your existing balance.

The WEP can reduce your benefit payment by as much as half the amount of your pension. Windfall Elimination Provision WEP The wind fall elimination provision WEP reduces the amount of Social Security benefits people can collect if they receive a government retirement plan in addition to Social Security. The estimate does not include WEP reduction.

FERS comes out ahead of CSRS if you retire late because the annuity value of your Social Security benefit and Thrift Savings Plan go up quickly if you continue to work past age 62. The Windfall Elimination Provision WEP affects members who apply for their own not spousal Social Security benefits. The Windfall Elimination Provision aims to prevent seniors from double dipping by receiving full Social Security benefits and a pension from a job where they didnt pay into the system.

Apart from saving make use of any large funds you get throughout the year. What is the maximum WEP reduction if I am currently due to get 1040 a month in retirement. The windfall elimination provision affects how the amount of your retirement or disability benefits is calculated if you receive a pension from work where Social Security taxes were.

The Windfall Elimination Provision results in a recalculation of the Primary Insurance Amount or PIA of the individual who is receiving a pension based upon earnings that were not subject to Social Security taxation. Youre correct that. If your pension is from what Social Security calls covered employment in which you paid Social Security payroll taxes it has no effect on your benefitsThe vast majority of.

Use the Social Security Benefit calculator to calculate this input. The WEP calculator and GPO calculator at Social Securitys website can help you estimate how much these rules will cut into. WEP generally affects government workers who qualify for a public pension that didnt require paying Social Security taxes a non-covered pension and who also worked at another job where they did pay Social Security taxes which qualified them for Social.

Social Securitys website provides a calculator to help you gauge the impact on your benefits from the Windfall Elimination Provision WEP the rule that reduces retirement benefits for workers who also collect a non-covered pension from a job in which they didnt pay Social Security taxesThe provision affects about 19 million Social Security beneficiaries most. I have 12 years of service contributing to social security. If you have a non-covered pension from work where you didnt pay SS taxes and a Social Security benefit from other work where you did pay SS taxes you need to understand the Windfall Elimination Provision.

The reduction cannot be more than half the amount of your monthly pension that is based on work not covered by Social Security. By Joan Hill. Windfall Elimination Provision Mechanics.

The WEP is simply an alternate formula for calculating Social Security benefits for those who have a pension from a job where no Social Security taxes were paid.

Calculators Social Security Intelligence

Calculating Regulatory Aum Vs Assets Under Advisement Aua Regulatory Asset Management

Social Security What Is The Windfall Elimination Provision How Does It Affect Your Benefits

Trs Options The Importance Of Choosing A Beneficiary Briaud Financial Advisors

Windfall Elimination Provision Wep Csrs Social Security Adjustment

Financial Ducks In A Row Independent Financial Advice Ira Social Security Income Tax And All Things Financial

Social Security Wep Fomo Idk Or Lol Retirement Insight And Trends

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence

Social Security Sers

How The Social Security Wep Or Gpo Could Ruin Your Retirement Retirable

How To Calculate Your Social Security Benefits A Step By Step Guide Social Security Intelligence

How The Csrs Offset Works

Calculators Social Security Intelligence

Calculators Social Security Intelligence

How The Government Pension Offset And Windfall Elimination Provision Affects Dually Entitled Spouses Social Security Intelligence

Social Security S Windfall Elimination Provision

/GettyImages-116763915-4608ba2ba59444cb84ecfc6657e27ff7.jpg)

How To Maximize Social Security Spousal Benefits